Banks and credit unions have various challenges concerning bank document management. Offsite banking document storage can help alleviate those challenges, especially when it comes to security, improving workflow, and maintaining regulatory compliance.

Understanding Banking Document Challenges

Document Security

Banks, credit unions, and other financial institutions handle many documents each day, many of which deal with sensitive financial information. Keeping this data secure is of tantamount importance, especially since a breach in security could result in massive losses in the form of lawsuits and lost reputation.

Maintaining physical document storage for banks on-site can become costly, and often, its efficacy is questionable. This means that even if sensitive files are not breached, the bank is still putting a fortune into making sure their data is secure.

Offsite bank document storage helps solve this problem in that it is a cost-effective way to securely store documents. The storage company absorbs the costs of security, and keeping data offsite places a barrier between the data and those who might try to access it for nefarious purposes.

Optimizing Workflow and Accessibility

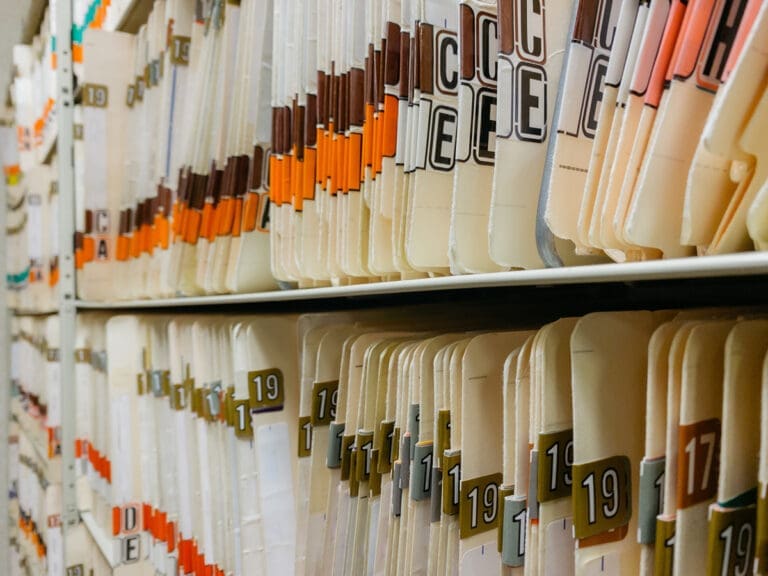

A consistent challenge in bank document management is efficient storage and rapid information retrieval. The flow of paperwork including applications, financial forms, and statements can be overwhelming, and making sure it’s all accounted for and properly filed can be an astronomical undertaking each and every day.

Often with offsite storage, speed is an issue, but if it’s well designed—such as with Armstrong Archives’ scan-on-demand services—important documents are available in an instant.

Struggling with Document Storage?

The team at Armstrong Archives is here to help! Our offsite record storage services and our digital and electronic records management services provide the security you need to protect your sensitive information in an organized manner. We also specialize in document scanning to help you get started with converting paper documents to digital files. To learn more contact our team.

Meeting Regulatory Compliance Issues in Financial Services

Compliance Issues

Another important component of offsite file storage for financial institutions is regulatory compliance. Banks, credit unions and other financial institutions have many federal regulations to follow when it comes to records management. Some of these regulations include

- Office of the Comptroller of the Currency (OCC) guidelines

- Securities and Exchange Commission (SEC) regulations

- Commodity Futures Trading Commission (CFTC) regulations, including Dodd-Frank

Such regulations shape how institutions manage their financial documents. Therefore, ensuring that any regulatory document management for financial services complies fully is imperative. Reliable offsite storage can help with those regulations by providing encryption for digital documents and secure document destruction for paper files.

Armstrong Archive: Your Trusted Document Management Partner

Armstrong Archives provides offsite storage solutions for banks and credit unions that help them meet the challenges of document management. To learn more about secure offsite storage for financial institutions, contact us today.

Posted By: Sherri Taylor – President/Managing Partner

Sherri Taylor is the Managing Partner and President of Armstrong Archives, one of the largest independent records and information management companies in the Dallas/Ft Worth area.