Introduction

The Sarbanes-Oxley Act (SOX) is a law passed in 2002 to set forth standards for the recording and reporting of corporate financial activities. The law came about as a result of several large accounting scandals during the early years of the 21st century. With little government oversight and no fear of criminal prosecution for their board members, many publicly traded companies fraudulently misrepresented their earnings, causing catastrophic financial losses for millions of innocent investors when the deceit was uncovered. This situation highlighted the importance of strict sox data retention requirements. In navigating these requirements, businesses often turn to specialized services like Armstrong Archives, which offer expertise in managing and securing essential financial records. As we delve deeper into the intricacies of SOX compliance and best practices for record retention, it becomes clear how services like Armstrong Archives play a pivotal role in ensuring that businesses meet these stringent standards.

Sarbanes-Oxley and Record Retention

Sarbanes-Oxley charges the Securities and Exchange Commission with creating regulations that specify how corporations must follow the law. A key part of that law involves record retention. Businesses must retain their records for set periods of time (and in some cases permanently, depending on the type of record) in order to be compliant with SOX compliance data retention. Here, we will review record retention best practices to ensure Sarbanes Oxley Act compliance.

The Main Challenge of SOX

SOX has presented a massive challenge to financial businesses everywhere since they now not only have to make regular and accurate reports, but they need to keep the records around that support the numbers in those reports. This means companies have to maintain millions of records, and that can get expensive. Managing data retention best practices is essential for compliance.

How to Remain SOX Compliant

Follow these steps to keep your organization compliant with the Sarbanes-Oxley Act.

- Internal Control Report – Company management is responsible for internal control (i.e. data security system) of financial records and for creating and implementing a process to maintain this control. This includes disclosing details on the internal financial reporting control system to the SEC. Management must also report on the effectiveness, and any weaknesses, of the internal control system in the company’s annual report. Any flaws or breaches must be disclosed as soon as they are discovered and included in the report.

- Independent Audit – An independent auditor must verify the accuracy of the information in the internal control report including that the internal financial structure of the company is in place and working properly. Auditors are also subject to punishment if they fail to keep audit or review documents for a minimum of 7 years.

- No Retaliation against Whistleblowers – The Act encourages those with knowledge of illegal corporate activity to report it and provides protection for those who do from retaliation. The Department of Justice is authorized to charge and prosecute those who retaliate against whistleblowers with a federal crime.

Planning Ahead

When it comes to best practices for records retention under SOX, the first thing that needs to happen is a plan. You need to put someone in charge of storing, organizing, and maintaining those records.

You also need to catalog what types of documents you’re dealing with and how long each of those needs to be retained. Any record that contains financial information should be accounted for, including:

- Financial statements

- Accounting records

- Sales reports

- Emails

- Memos

- Instant messages

- Bank statements

- Invoices

The list goes on. It may be tempting to try to keep everything indefinitely, but this is simply not possible or practical. It may even violate other regulations such as those governing client privacy.

Digitizing Documents

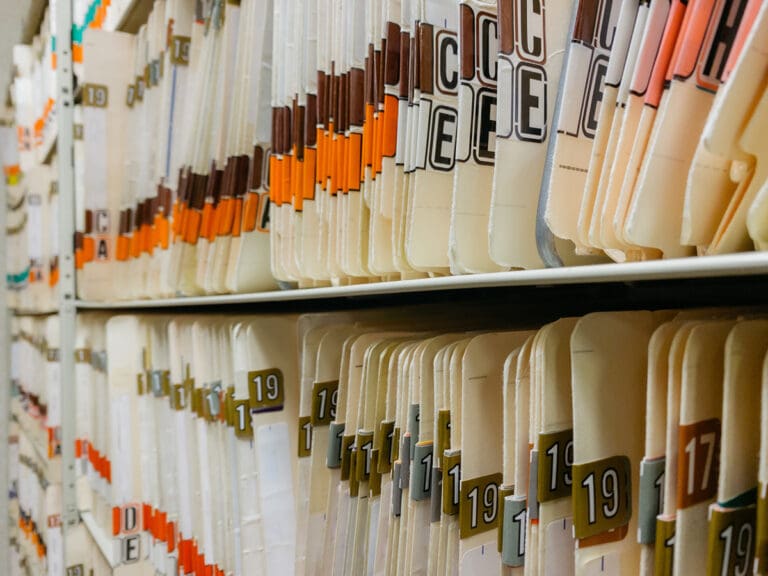

After planning, the next strong practice is to digitize all records. This massively reduces the physical space needed to store them, and it also facilitates security and retrieval. Document scanning services can convert paper documents into a digital format which can then be indexed into an organized database. Keeping payroll records, tax records, ledgers, and other records for 7+ years is far simpler without rooms full of filing cabinets.

Multiple Repositories

Finally, using multiple repositories is also crucial for records retention. If everything is kept in one place, it can be very easily lost, even if it’s in electronic format. Using multiple servers or storing data in the cloud can help, as can the offsite records storage offered by Armstrong Archives. This allows for enough redundancy that if something happens to one repository, you can still maintain compliance.

Not Indexing Expiration Dates

Many documents contain expiration dates, and failing to track them properly could greatly hamper your entire operation, even leave your company at risk.

Using the Wrong Records Management Service

If you do utilize a company to manage your documents, make sure they understand the specific needs of your business and operations. If they don’t, you might find that accessing your documents is no easier than it was prior to hiring them. The result? Wasted time and money.

While the aforementioned are some of the most common mistakes in document management, they’re not a comprehensive listing of the many considerations your company should be taking into account. An experienced, reputable document management company like Armstrong Archives will help you fill the gaps, ensuring your company can safely maintain and manage its important documents.

Frequently Asked Questions

Why did Congress pass the Sarbanes-Oxley Act?

The SOX was enacted to protect after numerous accounting scandals were revealed in big business. Companies like Enron, WorldCom, Tyco, and Global Crossing defrauded their investors and employees through unscrupulous and sloppy accounting practices. These scandals wound up costing billions of dollars in losses to both corporations and investors involved. SOX mandates financial reporting practices and internal controls for public companies in the U.S.

What companies need to comply with Sarbanes-Oxley?

Any public company in the country must comply with SOX, including those preparing for an initial public offering, to avoid an audit or review. SOX also applies to registered public accounting firms that audit or review companies subject to the act.

What does SOX compliance require?

All companies subject to SOX must establish a financial accounting framework that generates financial reports with easily traceable source data, which must remain intact and void of revisions. Should revisions occur to such documentation, what was changed, by whom, when, and why must all be noted clearly for records retention policies.

An important part of Sarbanes Oxley requirements is the inclusion of an internal control report that affirms that company management is responsible for all internal controls and any shortcomings they may have.

Conclusion

In today’s regulatory environment, understanding and implementing the sox data retention requirements is more critical than ever. Whether you’re grappling with SOX compliance or seeking to optimize your document management processes, partnering with the right expertise is key. If you’re looking to streamline your record retention process and ensure SOX compliance, contact Armstrong Archives today. Let us help you navigate the complexities of sox data retention requirements with ease and confidence.

Posted By: Sherri Taylor – President/Managing Partner

Sherri Taylor is the Managing Partner and President of Armstrong Archives, one of the largest independent records and information management companies in the Dallas/Ft Worth area.