Introduction: Navigating CPA Record Retention: Essential Guidelines and Best Practices

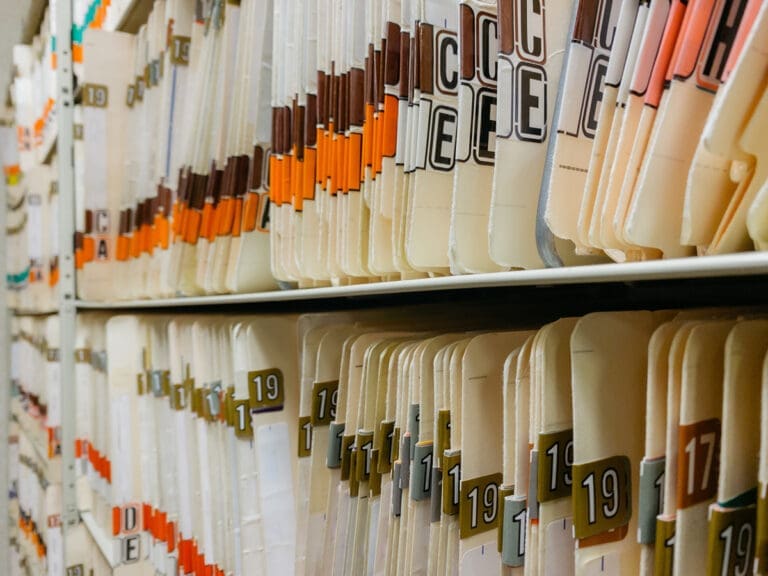

Navigating the requirements for cpa record retention is a critical part of any accounting professional’s role. Whether you’re a part of a small local firm or a major accounting enterprise, it’s essential to keep up with the aicpa document retention policy and gaap record retention guidelines. This guide aims to simplify the rules around how long CPAs should keep client records, helping you understand which documents you need to hold onto and for how long.

When it comes to managing records, Armstrong Archives offers a reliable solution that ensures both compliance with retention requirements and peace of mind. With our expertise in offsite document storage and management, you can trust that your records are in safe hands and accessible when you need them.

CPAs must retain tax records for 6 years under AICPA guidelines, while GAAP may require 7+ years for financial reports. Permanent retention applies to audit reports, corporate charters, deeds, and year-end financial statements. Secure destruction after retention periods is mandatory, but digital copies are compliant if unaltered and securely stored. State laws may extend retention beyond federal requirements.

Record Retention Essentials for CPAs

Managing a wide array of financial documents is a fundamental task for accounting professionals and CPAs. Federal guidelines set a baseline retention period of three years for tax records. However, to be on the safe side against potential IRS audits, it’s prudent to consider a six-year retention strategy. This section provides a practical walkthrough of CPA record retention requirements, outlining the necessary durations for different types of financial documents in line with AICPA and GAAP recommendations.

Records with a One-Year Requirement

When considering how long is a CPA required to keep client records, it starts with the basics. For daily operations with transient importance, a one-year retention period meets the minimum requirement. These documents may include:

- Customer and vendor correspondence

- Deposit slip duplicates

- Purchase orders

- Notebooks

- Requisitions and stockroom withdrawal forms

- Receiving sheets

- Personal payment stubs

- Retirement and mutual fund contribution statements

Documents to Keep for Three Years

Certain records need to be kept longer due to regulatory requirements or for reference. These three-year retention items consist of:

- Personnel records

- Employment applications

- General correspondence

- Expired insurance policies

- Internal reports, including audits

- Inventory tags

- Petty cash vouchers

- Employee savings bond registration records

- Time cards

- Credit card statements

- Medical bills

- Utility bills

Important Records with Extended Timelines

Some documents are pivotal for tax and legal purposes and should be kept for at least six years, such as:

- Supporting documents for tax returns

- Accident reports and claims

- Accounts payable and receivable

- Tax-related medical bills

- Bank statements

- Cancelled checks

- Employment tax records

- Expense analysis and distribution schedules

- Expired contracts and leases

- Inventories

- Invoices

- Notes receivable

- Sales records and receipts

- Time books

- Vouchers and voucher registers/schedules

- Travel and entertainment records

- Payroll records

- Property and improvement records

- Purchase orders

- Wage garnishments

- Sold stock and bond records

- Anything else tax-related

Records to Keep Permanently

These are the cornerstone documents of your business and should be kept indefinitely:

- CPA audit reports

- Legal records

- Tax returns, worksheets, and payment checks (including cancelled checks)

- Other important cancelled checks

- Corporate documents

- Account charts

- Cash books

- Deeds

- Fixed asset documents

- Depreciation schedules

- Current leases and contracts

- Year-end financial statements and balances

- General and private ledgers

- Journals

- IRS revenue agent reports

- Important correspondence

- Mortgages

- Bills of sale

- Property records and appraisals

- Pension and retirement records

- Patent and trademark registrations

- Director and stockholder minute books

- Investment trade confirmations

Safeguarding Records with Professional Solutions

As other items retain their importance over varying durations, such as vehicle records up to the point of sale, and warranty documents for the life span of the product, it becomes vital to engage with expert offsite records management services. Armstrong Archives offers such tailored solutions, ensuring legal compliance and readiness for any potential dispute or audit.

Conclusion: Ensuring Compliance through Effective Record Retention

In summation, compliance with CPA record retention requirements is a cornerstone of accounting practice management. Whether it’s preserving records for one, three, six years, or indefinitely, the process demands precision and foresight. By adhering to these directives and engaging specialized document management services, CPAs and accounting firms can ensure their readiness for any regulatory scrutiny or audits. The diligence with which you manage these records today will fortify the integrity and legacy of your fiscal responsibilities for the future.

For expert assistance in managing your record retention needs and to ensure your compliance is as seamless as possible, reach out to Armstrong Archives. Our tailored solutions provide the security and organization you need to focus on what you do best—managing your client’s financial futures. Contact us today to learn how we can support your record-keeping requirements.

Frequently Asked Questions

How long should CPAs keep tax records under AICPA guidelines?

The AICPA recommends retaining tax records and supporting documents for at least 6 years to safeguard against IRS audits, though some states may require longer periods.

What’s the difference between GAAP and IRS retention requirements?

GAAP focuses on financial reporting integrity (often 7+ years), while IRS rules mandate 3-6 years for tax documents. CPAs should follow the longer of the two when applicable.

Are digital copies of client records compliant with CPA retention rules?

Yes, if stored securely and unaltered. The AICPA permits digitized records but requires they meet the same retention timelines as paper originals.

Which CPA records must be kept permanently?

Critical documents like audit reports, corporate charters, deeds, and year-end financial statements should be retained indefinitely for legal and historical purposes.

Can CPAs destroy records after the retention period ends?

Yes, but destruction must be secure and documented (e.g., shredding paper, wiping digital files). Always verify state laws—some extend retention beyond federal requirements.

Posted By: Sherri Taylor – President/Managing Partner

Sherri Taylor is the Managing Partner and President of Armstrong Archives, one of the largest independent records and information management companies in the Dallas/Ft Worth area.