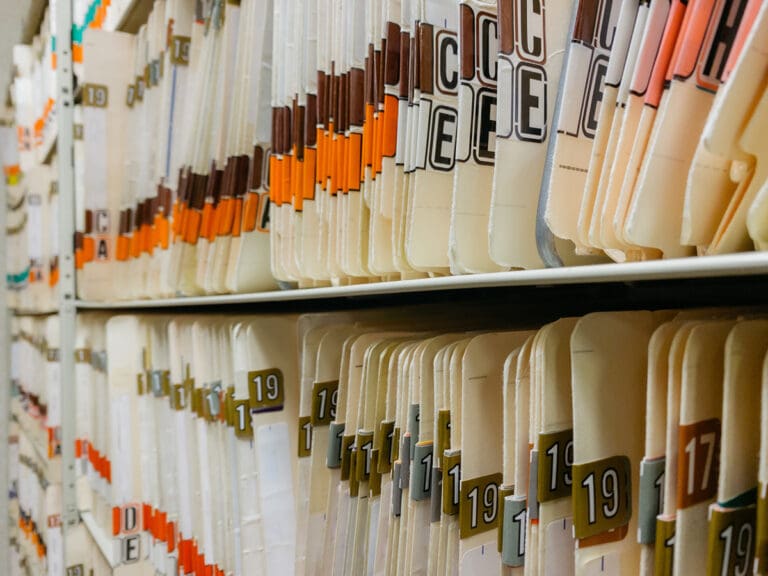

The task of in-house Record storage is a significant contributing factor in the ability to maintain organization over your personal and business records. It’s simply a necessary procedure for various reasons; it keeps critical documents organized allowing for easy retrieval when needed, and keeps information secure from potential threats. Without secure off-site record storage in Dallas, files can be easily lost, stolen or destroyed should your business become the victim of a fire or flood.

While producing electronic copies of all pertinent business information is important, it’s also wise to keep hard copies of certain documents. When it comes to both electronic and hard-copy record storage however, it can be an overwhelming task determining what should be securely destroyed, and what should be securely stored. So exactly what records should you keep on a permanent basis or short-term basis, and what can be disposed of?

Records You Should Store Permanently

- Keep annual tax returns permanently, in a secure record storage facility. This is critical in the event that your Texas business is audited. Although most audits will take place at seven years in, they could potentially take place at any time after that, should the IRS have suspicions that a fraudulent return has been filed.

- Certificates of stocks and bonds should be kept in a safe deposit box, or off-site in a record storage facility where they are in a safe area.

- Keep health records at home in a secure spot such as a lockable filing cabinet or desk.

- Keep any records of powers of attorney or wills. Usually there are several copies of wills, but one should be kept in a safe deposit box and another in a safe area within your Dallas home.

- Family birth certificates should be kept in a safe location, such as a safe deposit box. Adoption and custody records should also be stored on a permanent basis.

- Copies of death certificates should be kept in the home or in a safe deposit box.

Records to be Stored Temporarily

- Keep paycheck stubs for one year, up until W-2 forms or 1099 forms have been provided. The paycheck stubs should then be used to verify that the 1099 or W-2 forms are accurate.

- For tax reasons, keep W-2 forms or 1099s for seven years.

- Bills for the home should be kept for one year. Bills associated with your Dallas business or business related activities should be also be stored for up to for seven years.

- All mortgage statements must be stored for up to one year.

- Statements from mutual funds must be stored until the end of the year when they can be confirmed and reconciled.

- You should hang on to bank statements and credit card statements for one year. Be especially careful with credit card statements, as they are a leading source of identity theft

- Tax-deductible expense receipts should be stored for seven years. If there is a canceled check, this must also be stored for the full 7 years.

There are many benefits to storing your records off-site with Armstrong Archives Record Storage Solutions. Protect your information and data from both physical and digital threats. Contact us today to learn more about our secure, record storage services. Call 972.635.0983

Posted By: Sherri Taylor – President/Managing Partner

Sherri Taylor is the Managing Partner and President of Armstrong Archives, one of the largest independent records and information management companies in the Dallas/Ft Worth area.