Embracing Record Retention in the Digital Era

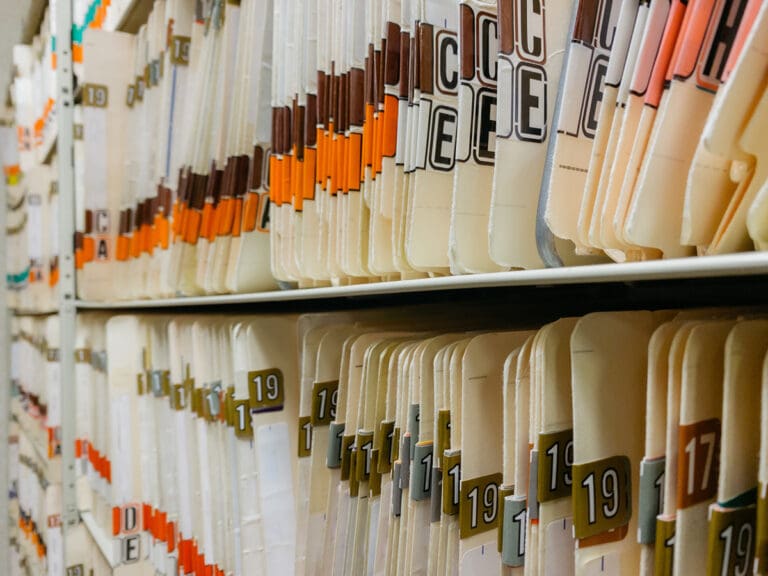

There’s no way around it: running a business generates a lot of records. Everything from tax documents to employee files to bank statements must be kept on file, often for years at a time. And while much of the world’s record-keeping has shifted to digital alternatives, traditional record-keeping practices still have a place.

Keeping track of your records as a business has never been more important. Whether it’s maintaining regulatory compliance or simply making tax season easier, an effective record retention strategy is paramount.

At Armstrong Archives, we’re proud to stand at the forefront of records management, offering expert guidance in record retention policy and document management, ensuring that our clients stay compliant and efficient.

What is Record Retention? Key Elements

A record retention policy is an organized framework that dictates how long business records should be kept before they are destroyed or archived.

No matter the size of a business, a well-defined record retention policy serves multiple purposes: ensuring compliance with legal and regulatory requirements, aiding in efficient document management, and securing sensitive information. Secure document disposal, as part of this comprehensive policy, protects against data breaches and maintains confidentiality, which is vital in today’s digital landscape.

Tailoring Record Retention Guidelines for Small Businesses

Small businesses must pay particularly careful attention to their record retention policies, as they often lack the extensive legal and compliance teams of larger businesses. Also, their policies must be tailored to their specific industry requirements and business size.

For instance, a small healthcare provider would need to retain patient records for a different duration than a retail business would need to keep sales invoices. This customization ensures that small businesses remain compliant without straining their available resources.

Developing a Comprehensive Business Records Retention Schedule

Creating a comprehensive business records retention schedule involves several steps.

- First, identify the types of records your business generates and categorize them (e.g., financial, personnel, customer-related). Each category will have different legal and operational retention requirements.

- Next, consult legal and industry-specific guidelines to determine the minimum retention periods. It’s important to note that some records might need to be retained indefinitely.

- Finally, regularly review and update the schedule to reflect changes in laws and business operations as they evolve.

Training Staff on Record Retention Policy

Employees at all levels should understand the importance of adhering to the company’s record retention policy. Training should cover how to classify, store, and eventually dispose of records according to the policy. Regular training sessions ensure that new employees are informed and existing staff are reminded of their responsibilities, reducing the risk of non-compliance.

Record Retention Guidelines: Industry-Specific Needs

The landscape of legal and regulatory requirements for record retention is as diverse as the industries it governs. Non-compliance can lead to severe penalties, including hefty fines and legal repercussions, so understanding these requirements is crucial for businesses to navigate the complexities of record management.

Federal Laws and Record Retention

At the federal level, laws like the Sarbanes-Oxley Act set stringent guidelines for record retention, particularly for public companies. This act mandates the retention of financial records and audits for a minimum of five years. Other federal laws, such as the Health Insurance Portability and Accountability Act (HIPAA), mandate specific retention periods (6 years in the case of HIPAA) for certain entities when it comes to retaining certain records.

Other federal agencies have their own specific retention guidelines, including:

- Occupational Safety and Health Act (OSHA)

- Family and Medical Leave Act (FMLA)

- Civil Rights Act of 1964

- Internal Revenue Service (IRS)

- Age Discrimination in Employment Act (ADEA)

- Fair Labor Standards Act (FLSA)

- Federal Insurance Contributions Act (FICA)

- Federal Unemployment Tax Act (FUTA)

- Equal Employment Opportunity Commission (EEOC)

- Americans with Disabilities Act (ADA)

- Employee Retirement and Income Security Act (ERISA)

State-Level Record Retention Rules

State-level regulations can add another layer of complexity. For instance, in Texas, the Texas Administrative Code provides detailed guidelines for various types of records.

These rules can be industry-specific, such as those for educational institutions or healthcare providers, dictating how long certain documents must be retained for purposes like audits or evaluations.

Industry Variations in Record Retention

Different industries face unique challenges and requirements when it comes to record retention.

For example, in the financial sector, institutions must retain records of transactions and customer interactions for a period defined by both federal and state regulations.

In contrast, the construction industry has a set of very different requirements, such as retaining project plans and contracts for a certain duration post-completion. Standard retention timelines for statutes of limitation and statutes of repose can run anywhere from 4-15 years.

Records Retention by Document Type

Which documents need to be retained? Records typically fall into several key categories:

- Business Documents: This includes contracts, mortgages, deeds, and general correspondence that form the backbone of your business dealings.

- Financial Records: These are crucial for financial tracking and include financial statements, expense reports, audits, and canceled checks.

- Personnel Records: This category covers employee-related documents such as applications, performance reviews, health benefits information, and termination letters.

- Tax Records: Essential for compliance, this includes IRS and state tax returns, sales tax records, payroll tax documents, and pension-related information.

- Purchasing and Sales Records: These are records related to transactions, including sales contracts, invoices, requisitions, and purchase orders.

- Shipping and Receiving Documents: This category encompasses freight bills, shipping and receiving reports, manifests, and bills of lading.

- Insurance Documents: These include policies, accident and safety reports, settlement claims, and group disability claims.

Different documents have varying retention periods. For example:

- Personnel records must be kept for 1 year

- Payroll records must be kept for 3 years

- Accounts receivable bills must be kept for 3 years after settlement

- Tax documents must be kept for 3-7 years

- Business documents can be retained for anywhere from 1, 3, or 7 years, depending on the situation

Additionally, while it’s generally accepted that records can be maintained electronically as long as their integrity isn’t compromised, there are a few implied exceptions, like:

- Probate documents (wills or trusts)

- Notarized contracts with raised seals

- Documents that convey property ownership (titles)

- Negotiable instruments (e.g., checks and assignable promissory notes)

Regardless of a document’s form, Armstrong Archives excels in offering tailored solutions for record-keeping across a diverse variety of industries. Whether that industry requires storing, scanning, or shredding services, we ensure that each business’s unique requirements are met.

Digital Transformation and Its Impact on Record Retention

The shift toward digital documentation has significantly impacted traditional record retention strategies. Digital records are easier to store, search, and share, making them much more convenient than their paper counterparts. However, they also require IT infrastructure to facilitate secure storage and backup.

Effectively managing the shift from traditional record-keeping to a digital world requires a nuanced understanding of the particulars and deep domain expertise. Armstrong Archives is proud to aid businesses in this transition, focusing on efficient scanning and electronic records management, ensuring that digital transformation enhances rather than hinders the record retention process.

Future-Proofing Your Business with Effective Record Retention

A well-structured record retention policy is crucial for business continuity and legal compliance. In the Dallas-Fort Worth area, Armstrong Archives offers unparalleled expertise in document management services, helping businesses navigate the complexities of record retention in an increasingly digital world.

Contact Armstrong Archives today for expert guidance and services in record retention and document management, ensuring your business is future-proofed and compliant.